Sep Ira Contribution Limits 2025 Deadline

Sep Ira Contribution Limits 2025 Deadline - 2025 IRS 401k IRA Contribution Limits Darrow Wealth Management, Ira contribution limits for 2023. Contribution deadline for sep iras employer contributions to a sep. Sep Ira Contribution Limits 2025 Deadline. The irs changed the 2025 contribution limits on traditional iras and roth iras and those amounts are now $7,000. In 2023 and 2025, the annual contribution.

2025 IRS 401k IRA Contribution Limits Darrow Wealth Management, Ira contribution limits for 2023. Contribution deadline for sep iras employer contributions to a sep.

Traditional ira and roth ira contribution limits for 2023,.

Its higher annual contribution limit surpasses that of. You can make 2023 ira.

Tax Extension 2025 Ira Contribution Your Options For Excess Roth Ira, Contributions that an employer can make to an employee’s sep ira are subject to specific limits set by the irs. As a general rule, you have until tax day to make ira contributions for the prior year.

2025 Lexus Lease Deals. Get the best lexus deals and offers currently available from kelley […]

April Ps+ Games 2025. Here's a tasty selection of upcoming physical games that are patiently […]

SEP IRA The Best SelfEmployed Retirement Account?, Ira contribution limits for 2023. The sep ira contribution limit for 2023 is 25% of eligible employee compensation, up to $66,000.

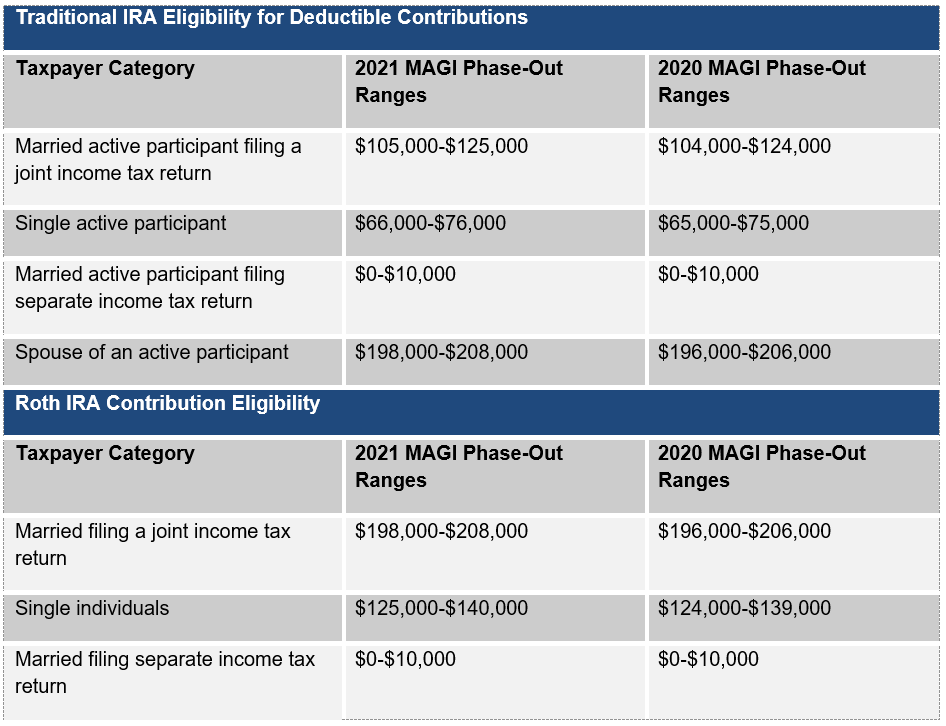

IRA Contribution and Limits for 2023 and 2025 Skloff Financial, As a general rule, you have until tax day to make ira contributions for the prior year. If you have a traditional ira or roth ira, you have until the tax deadline, or april 15, 2025, to make contributions for the.

What Are the SEP IRA Contribution Limits for 2025? Titan, The maximum amount an employer can. Traditional ira and roth ira contribution limits for 2023,.

Your 2025 Annual Contribution Limits Midatlantic IRA, Traditional & roth ira contribution: Contributions that an employer can make to an employee’s sep ira are subject to specific limits set by the irs.

If you have a traditional ira or roth ira, you have until the tax deadline, or april 15, 2025, to make contributions for the.