Cook County Property Taxes Due 2025

Cook County Property Taxes Due 2025 - Tax year 2025 second installment property tax due date: Taxpayers' Federation of Illinois Cook County Property Taxation The, Property taxes due this week; New penalty fee for late payers.

Tax year 2025 second installment property tax due date:

Cook County property taxes due Monday CBS Chicago, For next year, the property values will likely increase. Property tax payments are due june 3 and sept.

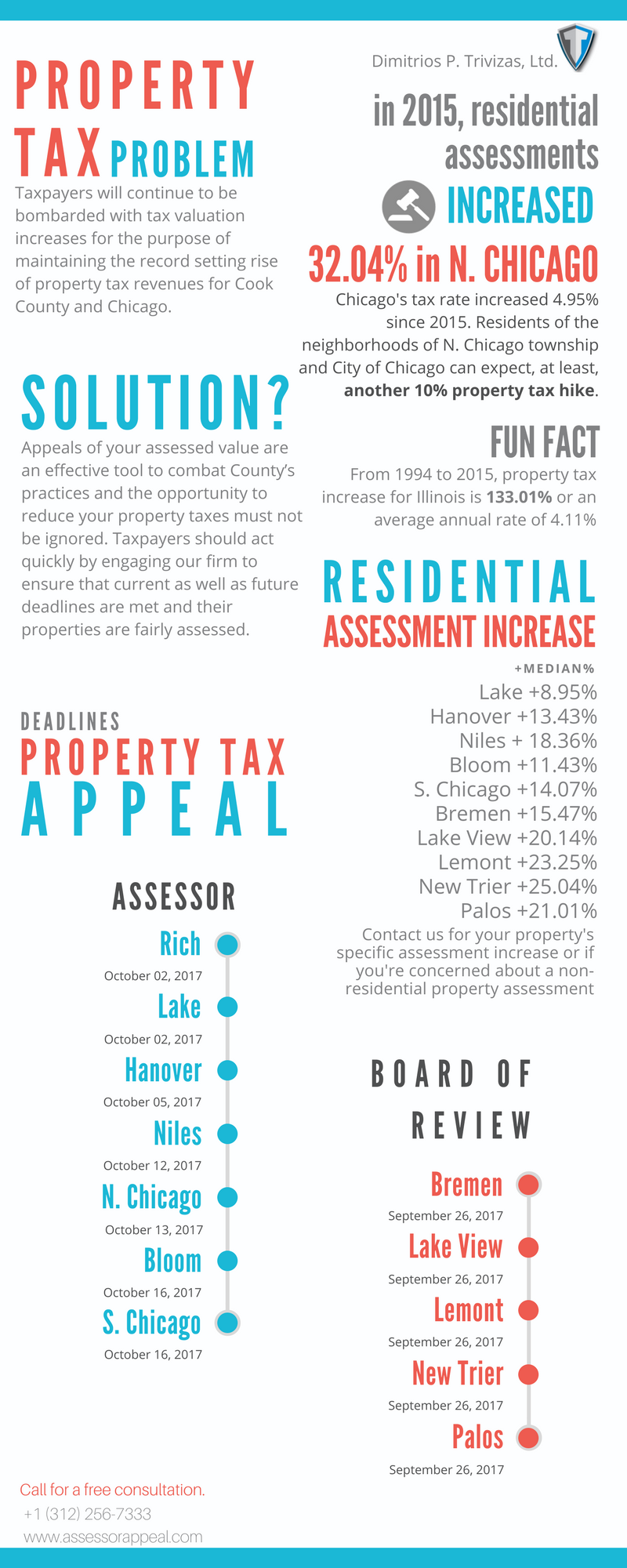

Cook County Property Tax Increase County Property Tax Appeal Deadlines, Property tax bills are divided into two. Cook county property owners can now pay the.

For taxes payable in 2023, the average increase for any given property in cook county was 31 percent. Cook county treasurer maria pappas has mailed nearly 1.8 million tax year 2023 first installment property tax bills.

Cook County Property Tax Due Dates 2025 Due Fiona Jessica, Cook county treasurer maria pappas announced tuesday that second installment bills for the 2025 tax year are available at cookcountytreasurer.com. Cook county property owners will have an extra month to pay their first installment property taxes this year, and their bills.

First installment of Cook County property taxes due April CBS Chicago, New penalty fee for late payers. Payments are due march 1, 2025.

Paying Back Stimulus Money 2025. The tax relief for american families and workers act of […]

Cook County Property Taxes Due 2025. Historic reforms championed by cook county treasurer maria pappas are about to take effect as property owners face a march 1 due date for 2023. Tax year 2023 first installment property tax due date:

Taxpayers' Federation of Illinois Cook County Property Taxation The, Property tax bills are mailed to owners. Your cook county property tax bill must be paid by friday.

Historic reforms championed by cook county treasurer maria pappas are about to take effect as property owners face a march 1 due date for 2023.

Cook County Chicago property taxes are about to soar Crain's Chicago, In the supreme court case, a condominium owner owed $15,000 in property taxes, so the county seized the property, sold it for $40,000 and kept the $25,000. Property tax bills are mailed to owners.